Did you know that the variable compensation program differs from the traditional salary as it is a bonus and professional recognition system that offers extra benefits in addition to the fixed payment?

This compensation model, increasingly adopted by organizations, stands out for its ability to motivate employees and drive results.

Therefore, understanding the nuances of variable compensation and its implementation is essential for business success. Keep reading to explore more about this compensation program and its benefits.

What you will find on this blog:

ToggleWhat is a Variable Compensation Program?

The concept of variable compensation is a payment modality that differs from the traditional fixed salary.

It consists of a fixed part and a variable one, subject to achieving the employee’s goals, results, and individual or collective performance.

Moreover, this compensation model is a strategic tool to motivate employees and align their interests with the company’s objectives.

Generally, large and successful institutions worldwide use the variable compensation program. Still, it can and should be implemented in companies of all sizes to value their human capital and drive results.

Types of variable compensation

There are various types of variable compensation, each with its characteristics and benefits. Check out the primary examples below:

1- Commissions

Commissions are one of the most common forms of Variable Compensation, especially in sectors like sales and customer service.

In this modality, employees receive a percentage of the value of sales made or contracts closed, incentivizing them to achieve better results.

2- Performance bonuses

Performance bonuses are granted based on the achievement of pre-established goals and objectives.

Additionally, these bonuses can be individual, departmental, or even organizational, serving as recognition for the effort and dedication of employees in exceeding expectations.

3- Profit-sharing

A participação nos lucros e resultados é uma forma de RV na qual os colaboradores recebem uma parcela dos lucros obtidos pela empresa.

Thus, this model encourages employee engagement in contributing to organizational success, as their performance directly impacts financial results.

Looking for bonus software? Discover Score by Actio!

What are the advantages and disadvantages of variable compensation?

When implementing any strategy, analyzing the benefits and associated risks is essential. Below are some of them:

Advantages of variable compensation

- Stimulates motivation and engagement of employees;

- Promotes a culture of meritocracy and recognition of individual performance;

- Reinforces organizational values and vision;

- Flexibilizes fixed costs, providing financial adaptability.

Disadvantages of variable compensation

- Poorly defined or unattainable goals can result in demotivation;

- Identifying clear and relevant indicators can be challenging, especially in specific sectors;

- Inadequate implementation can lead to adverse outcomes and undesired incentives.

How do you implement variable compensation in your company?

Now that you know the advantages and disadvantages of variable compensation, learning how to apply it effectively is essential.

Implementing a VC system requires attention to some crucial aspects to ensure that it works as expected and benefits the company and its employees. See below how to do it:

1- Definition of performance indicators

Firstly, it is crucial to establish performance indicators (KPIs) that allow evaluating the progress and performance of employees.

That is, these indicators must be directly linked to the organization’s strategic objectives, reflecting the goals of each sector or professional.

2- Determination of criteria and goals

After defining the indicators, it is necessary to establish clear criteria and achievable goals for the variable compensation program.

Thus, this includes determining the value of VC, the campaign period (if applicable), minimum and maximum values of the amount to be granted, eligibility criteria, and how prizes will be calculated.

3- Monitoring program execution

Continuous monitoring of the implementation of the VC program is essential to assess its effectiveness and make adjustments as necessary.

In this case, it involves the periodic generation of reports presenting relevant data and metrics, allowing a detailed analysis of the program’s performance.

4- Calculation of return on investment (ROI)

Finally, besides monitoring performance, it is fundamental to calculate the Return on Investment (ROI) of the VC program.

This allows evaluating whether the financial benefits generated by the program justify the investments made, ensuring that it is aligned with the company’s financial goals and objectives.

Why invest in variable compensation with the help of software?

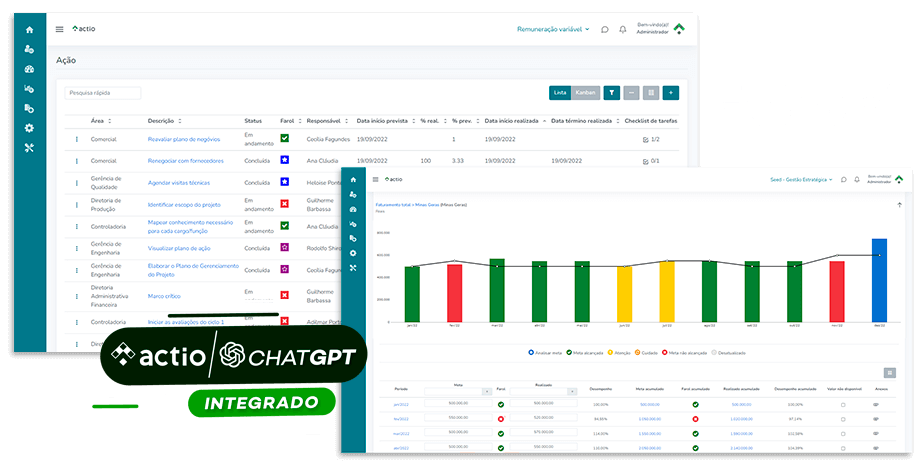

Technology can help you choose the benefit that best suits your company. Therefore, Actio desenvolveu o software Score; the only remuneration system approved by Falconi, the largest consultancy in Brazil.

With Score by Actio, you will have real-time access to individual results, allowing clear visibility in the variable remuneration process. The software also calculates commissions, ICP, PLR, bonuses, ILP, and much more, adapting to your organization’s specific needs. If facing challenges in this area, consider Actio’s software to simplify the process.

Frequently Asked Questions

1- What does variable compensation mean?

Variable Compensation is a form of compensation subject to changes based on individual, team, or organizational performance.

Instead of a fixed value, such as a monthly salary, It can include bonuses, commissions, profit-sharing, or other incentives determined by achieved results.

2- What is the importance of a variable compensation program?

The variable compensation program is crucial because it motivates employees to achieve specific goals and contribute to the company’s success.

Thus, it directly links performance and compensation, encouraging excellence, commitment, and productivity.

Additionally, it helps align employees’ individual goals with the organization’s overall objectives.

3- How to calculate variable compensation?

The calculation of VC can vary depending on the type of program the company adopts. Generally, it involves establishing measurable and objective goals that employees must achieve to qualify for variable compensation. Calculations may include a percentage of generated profit, a fixed value per unit sold, or other specific performance criteria.

Calculations may include a percentage of generated profit, a fixed value per unit sold, or other specific performance criteria.

However, the criteria and calculation process need to be transparent and communicated to employees to ensure the effectiveness and fairness of the Variable Compensation program.

Conclusion

Variable compensation is a powerful tool to encourage performance and achieve superior results.

However, its implementation requires careful planning and a deep understanding of employees’ needs and expectations.

By adopting a strategic and transparent approach, companies can reap the benefits of Variable Compensation and promote a culture of excellence and success.

Don’t forget to follow Actio on Instagram, Linkedin and Facebook.

Did you like the content? Tell me in the comments.