It is essential to carry out risk management, because building a business empire through the products that your company offers, growing exponentially and being the owner of one of the best companies on the market will not exempt you from the risks that exist, both external and internal, as they are inevitable and all companies are subject to them.

Assuming that risks exist regardless of how good a company is, it is necessary to pay attention to the ways of investigating and implementing solutions, adopting a risk management system so that managers and employees are committed to reducing the probabilities of risks happening.

O que você vai encontrar neste blog:

ToggleWhat is risk management?

Implement it in your company with a simple tool

As it is understood, “risk” means something that has not yet happened, but which we are subject to. Therefore, risks in a company are the result of unexpected events in relation to managers’ expectations. They can occur by a future event, circumstance or condition.

Furthermore, risk management is a compilation of coordinated activities, whose objective is to control and manage risks that may become a reality in an organization, regardless of their manifestation.

This is the strategy that involves prevention and prescription. In general, it is important to anticipate risks and act before they happen, or act promptly if the risk has already become a reality.

For everything to go well and the suspicion of risk to be resolved, the organization needs to have tools (such as software) focused on the subject, in order to adopt efficient initiatives in case of changes and oscillations in the company’s daily events or external events that end up arriving by surprise and causing discomfort.

There are several types of risk and companies are exposed to all of them. Let’s look at some examples:

Operational risks

This risk model consists of those that occur due to failures in internal and external processes, people and systems that constitute an organization.

Operational risks are generally specific to each sector, and a great tip to avoid them is to map processes in order to identify the points most susceptible to risks in order to draw up plans and eradicate them.

Strategic risks

This risk concerns the factors that indicate problems in the company’s strategies. To avoid them, it is advisable for the corporation to have its goals clearly established and its vision and values exposed and clarified, as it is from these pillars that managers and employees will work.

Classifying priorities according to the needs of the company is fundamental in these cases. For this, it is important to use tools such as SWOT, which analyzes internal and external aspects, such as strength, weakness, opportunities and threats, in order to reduce damage and manage to mitigate some dangers.

Cyber risks

Malicious people are everywhere. Therefore, protecting the company’s information and its security through an excellent security system, such as an antivirus and a firewall, is of paramount importance to prevent valuable information from being accessed by intruders.

Another important point is to keep confidential customer data and information safe. Therefore, investing in cryptography for websites, in addition to guaranteeing security and protection at the time of conversation between the customer and the company, is fundamental.

Ways to use risk management in your company

You must be wondering: “how to use risk management in my company?”. Ideally, there should be skills, systems, tools and methods in place to manage risk on a daily basis.

Therefore, always prepared, each manager will know, through the risks, what the company is exposed to. You can apply risk management to a variety of activities, such as:

1- Task monitoring and internal controls

2- Risk leadership and management

3- Monitoring the company’s performance

4- Sharing information with agility and transparency

5- Analysis of the results that the company wants to achieve

Benefits of using risk management

Now that you’ve seen what risks management is and how to implement it in your company, let’s get to the benefits.

Efficient operations:

Mitigating risks or mapping them helps both the company and its employees to work more efficiently. Care in establishing a security system makes the work environment more harmonious and safe, generating satisfaction and confidence in employees. It is the company’s responsibility to guarantee human resources and to be concerned with the well-being of the team.

Reduction of costs and expenses:

Acting assertively and intelligently brings great benefits, such as reducing costs and expenses. The improvement in results is also linked to the extent to which the company is able to save money and reduce expenses.

Credibility:

Applying risk management in your company generates great credibility, as it gives a feeling of security and reliability both for those who hire your services and for those who work in your company. The high standard of management is praised and serves as an inspiration for other companies that want the same excellence and professionalism.

As all sectors of a company are relevant, everything needs to be included in a risk manager’s planning.

In this case, people management, managerial skills, systematic vision, strategies and leadership spirit must go hand in hand.

Get to know Belt by Actio, risk management software

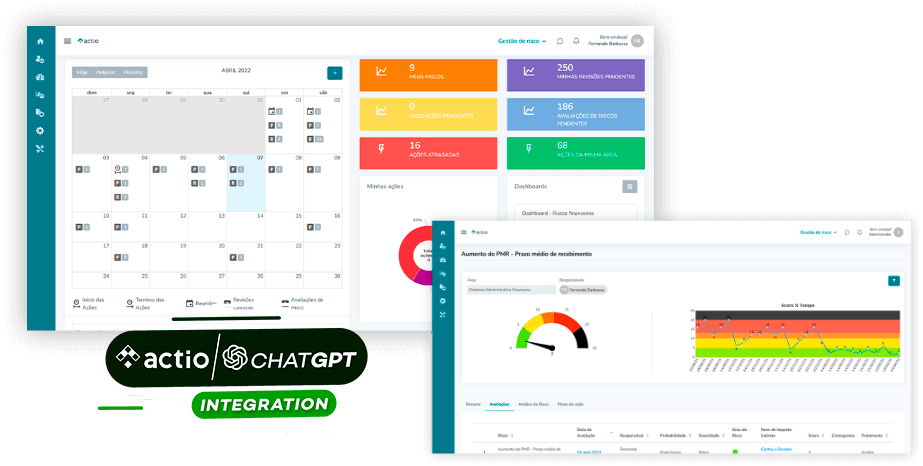

Due to the utmost importance of corporate risk management, we at Actio, a company within the Falconi group, have developed Belt by Actio—a software designed to meet your organization’s needs.

Furthermore, with centralized communication, this software can be a valuable tool to assist you in tracking actions, creating risk matrices, mitigation plans, and much more.

Success stories, such as how the Oswaldo Cruz Hospital already uses risk management software to improve business performance, demonstrate that Belt by Actio allows for creating better plans to reduce these risks and implement effective controls. Take advantage of the opportunity to enhance your business’s competitive advantage.

Like the content? Don’t forget to follow Actio on Instagram, LinkedIn, and Facebook.